13. April 2021

by Reto

Comments Off on Bitcoin shows upward trend: Still interesting for casinos

While Bitcoin and Co stagnated in January, February showed an interesting upward trend so far. The temporary low point of Bitcoin was not reached until November 2018. But since the end of January, a clear increase can be seen. However, this development is not limited to a crypto currency. Ethereum (ETH), Bitcoin Cash and EOS have also made gains on the markets.

But what influences the price performance of Bitcoin and Co at all?

Let’s first analyse the Bitcoin bubble. The enormously rapid growth had reached its peak. As a result, there was a price correction. The chart showed a clear downward trend. Now the question arises whether the crypto currencies have grown up. If these are used more in daily life, then other online casinos would certainly also allow paying with Bitcoin and Co. Some virtual casinos have already added crypto currencies to their payment methods.

How has Bitcoin developed over the past years and months?

A review of the last three years shows an amazing chart. In March of 2016, Bitcoin was largely unknown. Its value was just under 376 euros. A creeping rise set in motion. In April 2017, the value of a Bitcoin was already 1,125 euros. In June of the same year it was already 2,323 Euros. And in December 2017 the probably best known crypto currency reached its peak. A virtual coin was worth 12,255 Euro at this time. But at that time the bubble was so bloated that it simply had to burst. Just two months later, in February 2018, the price was still 7,582 euros. In June last year, the price stood at 5,817 euros. And even from October with 5,590 euros it went further down to December, where the value finally came to 3,247 euros.

A review of the last three years shows an amazing chart. In March of 2016, Bitcoin was largely unknown. Its value was just under 376 euros. A creeping rise set in motion. In April 2017, the value of a Bitcoin was already 1,125 euros. In June of the same year it was already 2,323 Euros. And in December 2017 the probably best known crypto currency reached its peak. A virtual coin was worth 12,255 Euro at this time. But at that time the bubble was so bloated that it simply had to burst. Just two months later, in February 2018, the price was still 7,582 euros. In June last year, the price stood at 5,817 euros. And even from October with 5,590 euros it went further down to December, where the value finally came to 3,247 euros.

Even if we restrict ourselves to the past year, there is still a clear downward trend to be seen. On 26 February 2018, the share price finally stood at EUR 8,642. And on 18 February 2019 it was only 3,350 euros. But the Bitcoin has apparently passed its low point, as the ARD stock exchange reports. On December 10, 2018, the virtual currency suffered its lowest value in recent years at 2,953 euros. The chart temporarily dropped again to 3,001 euros on 28 January 2019. But in recent weeks the price has risen again by several hundred points. Is the Bitcoin now steadily rising? Perhaps the crypto currency will face healthier growth than it did at the end of 2017. But there are also uncertainties. Because the Bitcoin is not without competition.

Flying high: The peak value of the Bitcoin was 12,255 Euros. At the beginning of 2016, buyers paid only 376 euros. Those who entered the market with 10 coins at that time, i.e. had invested 3,760 Euros, were able to sell their system again with up to 122,550 Euros.

Why does the Bitcoin Chart currently point upwards?

The development of the past was marked by great enthusiasm. A new payment method had emerged that could revolutionize the payment process on the Internet. However, the further development of Bitcoin could not keep up with the upturn in the market. Currently the situation has cooled down. A slight increase can currently be recorded. This is based on the American bank JP Morgan. This is because a related technology is currently being used there. In the last week the bank had announced that in the future it wanted to rely on a specially developed crypto currency. This will enable payments between business customers to be processed. This news has provided the market with fresh impulses. The newly created currency runs under the name JPM Coin.

Not only the Bitcoin has increased in the past month. The litecoin most likely gained in value with over 40 percent. Ethereum also increased by more than 20 percentage points. Monero ranks just below. Only then does the Bitcoin itself come with an increase of 10 percent. Finally, Ripple is mentioned, which can only be found just above its starting position in the 30-day interval. With a total of more than 70 crypto currencies on the market, it is ultimately not at all certain which currency(s) will prevail the most. Bitcoin is clearly ahead of Etherum in terms of market value, which in turn moves just ahead of Bitcoin Cach. In terms of market capitalisation, Ripple is in third place, behind Bitcoin and Ethereum.

Not only the Bitcoin has increased in the past month. The litecoin most likely gained in value with over 40 percent. Ethereum also increased by more than 20 percentage points. Monero ranks just below. Only then does the Bitcoin itself come with an increase of 10 percent. Finally, Ripple is mentioned, which can only be found just above its starting position in the 30-day interval. With a total of more than 70 crypto currencies on the market, it is ultimately not at all certain which currency(s) will prevail the most. Bitcoin is clearly ahead of Etherum in terms of market value, which in turn moves just ahead of Bitcoin Cach. In terms of market capitalisation, Ripple is in third place, behind Bitcoin and Ethereum.

Bitcoin Casinos: Where can I pay with the crypto currency?

Did you know, that there are even bitcoin cards? Check the article at southfloridareporter.com for more info. Those who call Bitcoins their own cannot only use them as a financial investment. The virtual currency serves a purpose. It can be used to pay online – for example the online casino. DrückGlück, for example, already announced in January 2018 that it wanted to use the Bitcoin for deposits and withdrawals. Wunderino can also pay with Bitcoins using the Cubid payment method. However, the available payment methods often depend on the customer’s location. If you want to play from Germany, you can find completely different payment methods than a player from Denmark. If the upward trend continues, it can be assumed that other casinos will offer crypto currencies for payment.

SaferVPN has been a recent addition in the global market of VPN, since it was established in 2013 on the country of Israel. This location makes it possible for the subscribers to overcome the data retention laws applied in the United States and so on. But on the other hand – israel is also not known as a harbor for freedom.

SaferVPN has been a recent addition in the global market of VPN, since it was established in 2013 on the country of Israel. This location makes it possible for the subscribers to overcome the data retention laws applied in the United States and so on. But on the other hand – israel is also not known as a harbor for freedom.

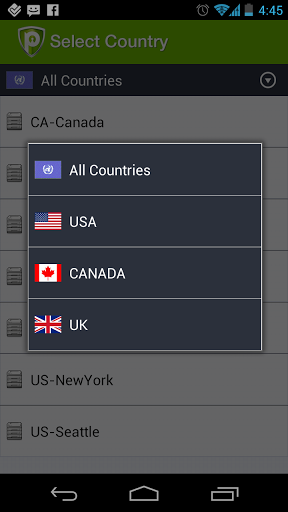

PureVPN is located in Hong Kong, which makes it easier to keep up with the demands for utter privacy and zero logging (unlike VPNs in the United States, for example). With an impressive array of special features and with a modern looking, customizable interface, PureVPN is a great solution for Android running devices.

PureVPN is located in Hong Kong, which makes it easier to keep up with the demands for utter privacy and zero logging (unlike VPNs in the United States, for example). With an impressive array of special features and with a modern looking, customizable interface, PureVPN is a great solution for Android running devices. Set Up VPN on Your Android Device Today and Browse with Renewed Freedom!

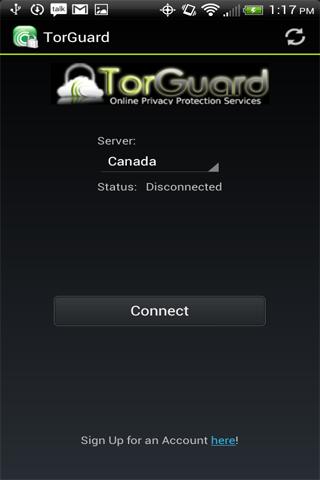

Set Up VPN on Your Android Device Today and Browse with Renewed Freedom! TorGuard VPN has become a worthy opponent in the field of VPN services provided globally. Seeking to combine modernity alongside efficiency, advanced encryption and the power and versatile nature of DNS with the VPN, TorGuard VPN is a solid solution.

TorGuard VPN has become a worthy opponent in the field of VPN services provided globally. Seeking to combine modernity alongside efficiency, advanced encryption and the power and versatile nature of DNS with the VPN, TorGuard VPN is a solid solution.

John McAfee loves to polarize. Without a doubt, he is one of the most dazzling and eccentric personalities in the crypto community. As early as July 2017, he predicted the Bitcoin price at $500,000 by 2020, which he corrected to $1 million because he hadn’t anticipated in his models that the price would develop so positively by the end of 2017. While this may sound very utopian, McAfee never tires of pointing out that this is an extremely conservative price target. BTC has reached $10.000 several times already, as you may read at

John McAfee loves to polarize. Without a doubt, he is one of the most dazzling and eccentric personalities in the crypto community. As early as July 2017, he predicted the Bitcoin price at $500,000 by 2020, which he corrected to $1 million because he hadn’t anticipated in his models that the price would develop so positively by the end of 2017. While this may sound very utopian, McAfee never tires of pointing out that this is an extremely conservative price target. BTC has reached $10.000 several times already, as you may read at

Binance also announced in a press release on Wednesday night that it had discovered a major security problem on Tuesday. Among other things, hackers could have picked up codes used to secure accounts during two-factor authentication – as well as API keys that can be used to connect Binance to third-party programs such as crypto apps. “The hackers used a variety of techniques,” writes Binance, “including phishing and virus attacks, but also other attacks.

Binance also announced in a press release on Wednesday night that it had discovered a major security problem on Tuesday. Among other things, hackers could have picked up codes used to secure accounts during two-factor authentication – as well as API keys that can be used to connect Binance to third-party programs such as crypto apps. “The hackers used a variety of techniques,” writes Binance, “including phishing and virus attacks, but also other attacks.

As Changpeng Zhao also says in his video, the hackers succeeded in tricking the stock exchange into carrying out security checks. Binance now wants to carry out a security check on its system. It is expected that neither withdrawals nor deposits will be possible on the platform for a week. A press release says: “Please understand that hackers may still be controlling some user accounts in the meantime and using them to influence prices”.

As Changpeng Zhao also says in his video, the hackers succeeded in tricking the stock exchange into carrying out security checks. Binance now wants to carry out a security check on its system. It is expected that neither withdrawals nor deposits will be possible on the platform for a week. A press release says: “Please understand that hackers may still be controlling some user accounts in the meantime and using them to influence prices”.

The first indications of margin trading on Binance appeared in a tweet on 24 May. In this tweet, Binance gave an insight into its new user interface with a screenshot post. However, a clearly visible button for margin trading attracted more attention than the new user interface.

The first indications of margin trading on Binance appeared in a tweet on 24 May. In this tweet, Binance gave an insight into its new user interface with a screenshot post. However, a clearly visible button for margin trading attracted more attention than the new user interface.

On the other hand, margin trading enables short selling and in the past, many believe it was responsible for the sharp drop in the Bitcoin price. However, this is a questionable assumption. Short selling takes place in traditional markets and should contribute to overall stability. After all, betting in the market works in both directions to balance each other out.

On the other hand, margin trading enables short selling and in the past, many believe it was responsible for the sharp drop in the Bitcoin price. However, this is a questionable assumption. Short selling takes place in traditional markets and should contribute to overall stability. After all, betting in the market works in both directions to balance each other out.

A review of the last three years shows an amazing chart. In March of 2016, Bitcoin was largely unknown. Its value was just under 376 euros. A creeping rise set in motion. In April 2017, the value of a Bitcoin was already 1,125 euros. In June of the same year it was already 2,323 Euros. And in December 2017 the probably best known crypto currency reached its peak. A virtual coin was worth 12,255 Euro at this time. But at that time the bubble was so bloated that it simply had to burst. Just two months later, in February 2018, the price was still 7,582 euros. In June last year, the price stood at 5,817 euros. And even from October with 5,590 euros it went further down to December, where the value finally came to 3,247 euros.

A review of the last three years shows an amazing chart. In March of 2016, Bitcoin was largely unknown. Its value was just under 376 euros. A creeping rise set in motion. In April 2017, the value of a Bitcoin was already 1,125 euros. In June of the same year it was already 2,323 Euros. And in December 2017 the probably best known crypto currency reached its peak. A virtual coin was worth 12,255 Euro at this time. But at that time the bubble was so bloated that it simply had to burst. Just two months later, in February 2018, the price was still 7,582 euros. In June last year, the price stood at 5,817 euros. And even from October with 5,590 euros it went further down to December, where the value finally came to 3,247 euros. Not only the Bitcoin has increased in the past month. The litecoin most likely gained in value with over 40 percent. Ethereum also increased by more than 20 percentage points. Monero ranks just below. Only then does the Bitcoin itself come with an increase of 10 percent. Finally, Ripple is mentioned, which can only be found just above its starting position in the 30-day interval. With a total of more than 70 crypto currencies on the market, it is ultimately not at all certain which currency(s) will prevail the most. Bitcoin is clearly ahead of Etherum in terms of market value, which in turn moves just ahead of Bitcoin Cach. In terms of market capitalisation, Ripple is in third place, behind Bitcoin and

Not only the Bitcoin has increased in the past month. The litecoin most likely gained in value with over 40 percent. Ethereum also increased by more than 20 percentage points. Monero ranks just below. Only then does the Bitcoin itself come with an increase of 10 percent. Finally, Ripple is mentioned, which can only be found just above its starting position in the 30-day interval. With a total of more than 70 crypto currencies on the market, it is ultimately not at all certain which currency(s) will prevail the most. Bitcoin is clearly ahead of Etherum in terms of market value, which in turn moves just ahead of Bitcoin Cach. In terms of market capitalisation, Ripple is in third place, behind Bitcoin and

We find the phrase “cloud-centered VPS hosting” quite frequently right now. Many people don’t know the difference between normal VPS and cloud-centered VPS hosting as both equally attract assets from one resource and equally use

We find the phrase “cloud-centered VPS hosting” quite frequently right now. Many people don’t know the difference between normal VPS and cloud-centered VPS hosting as both equally attract assets from one resource and equally use